|

|

|---|

|

American Politics Journal Atrios Barry Crimmins Betty Bowers Buzzflash Consortium News Daily Howler Daily Kos Democatic Underground Disinfotainment Today Evil GOP Bastards Faux News Channel Greg Palast The Hollywood Liberal Internet Weekly Jesus General Joe Conason Josh Marshall Liberal Oasis Make Them Accountable Mark Morford Mike Malloy Political Humor - About.com Political Wire Randi Rhodes Rude Pundit Smirking Chimp Take Back the Media Whitehouse.org More Links |

Subject: you asked about taxfoundation.org

Bart, you asked,

> Who is taxfoundation.org?

Well, they're a nonpartisan educational institution

that has been commenting on taxes for over 70 years.

They also have a reply

to the email you quote, stating that it is "incorrect":

Another point here is that the supposed taxpayer

has no children and takes the standard deduction,

less common for those with higher incomes.

The email ignores the Alternative Minimum Tax (AMT),

which tends to affect those who take large deductions

or pay high state taxes -- such as people who

live in California, Massachusetts, and New York

(incidentally, liberal states).

Plus, it (as usual) ignores state taxes and Social

Security.

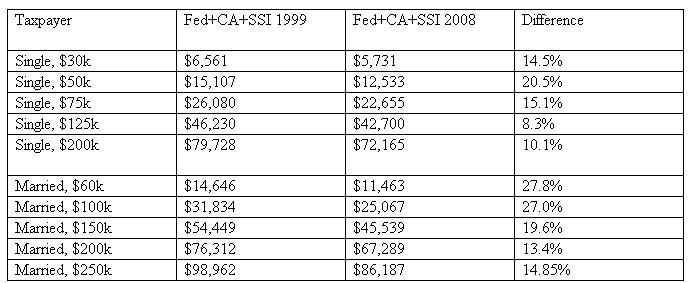

So here's a slightly corrected table, based on living in California:

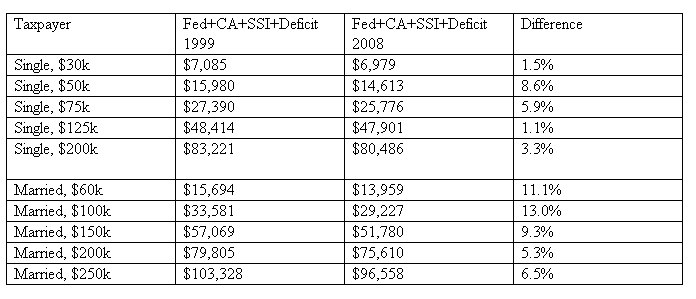

Now let's consider the effects of the deficit. Assuming we spread the deficit as a future tax based on income:

We can see a couple things here. First,

the worst place to be is earning ~$125k if you're single and ~$200k

if you're married; people earning less than you

or more than you got better cuts. Second, married people

got better tax cuts than single people.

There are two other important things to note.

First, these tables only go up to $200k for single people and

$250k for married. People with really large

incomes, and there are more of these each year, got even

higher percentage cuts...plus they tend to have

more deductions. Second, even the second table only looks

at the annual deficit, not the actual debt.

As the debt increases, its interest increases (and the interest rate

tends to increase as well). So the future

"deficit tax" is some 30x the current "deficit tax" calculated for that

table.

Russ

Send e-mail

to Bart | Discuss

it on The BartCop Forum | Comment

on it at the BartBlog